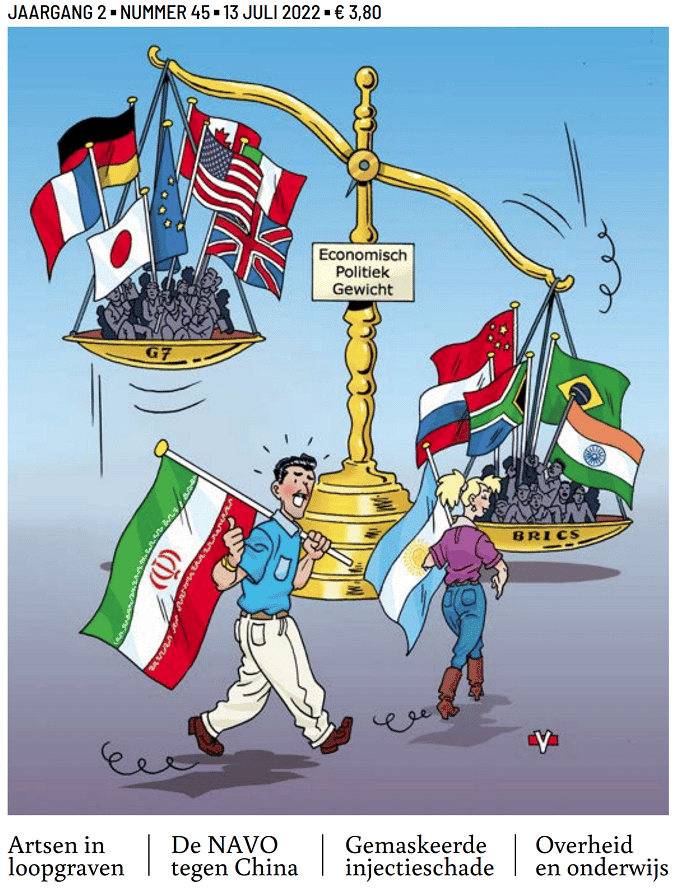

Nummer 45 (13 juli 2022)

In dit nummer:

Artsen in de loopgraven

Long Covid en SADS maskeren injectieschade

De NAVO gaat zich ook met China bezighouden

De Europese Unie als antirechtsstaat

Pinautomaten op de schroothoop

Ben je (nog) geen abonnee?

Gezond Verstand is voor abonnees online te lezen.

Ben je nog geen abonnee? Meld je dan hier aan.

Je kunt Gezond Verstand ook los bestellen of downloaden (PDF) in de webshop.